Traditional paper check stubs are becoming outdated and cumbersome, leading many companies to adopt free online check stubs as part of their operations.

What are online check stubs?

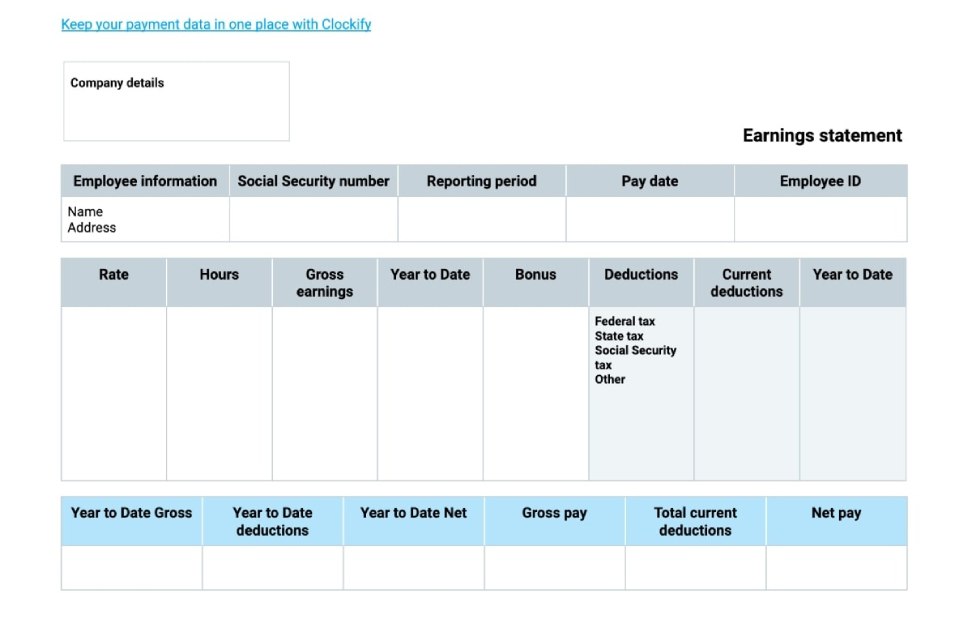

Online check stubs, also known as electronic pay stubs or e-stubs, are digital documents that provide employees with detailed information about their pay. They typically include details such as earnings, deductions, taxes, and net pay, mirroring the information found on traditional paper pay stubs.

Importance of online check stubs in modern business operations.

With the rise of remote work and the increasing digitization of business processes, online check stubs offer numerous advantages over their paper counterparts. They provide greater accessibility, reduce paper waste, and offer enhanced security features to protect sensitive employee information.

Benefits of Integrating Online Check Stubs

Accessibility and convenience.

One of the primary benefits of pay stub generator is their accessibility. Employees can access their pay stubs from anywhere with an internet connection, eliminating the need for physical copies or visits to the HR department. This convenience saves time and reduces administrative burden for both employees and employers.

Cost-effectiveness.

Switching to online check stubs can lead to significant cost savings for businesses. Eliminating the need for paper, ink, and postage reduces overhead expenses associated with printing and mailing paper pay stubs. Additionally, digital storage eliminates the need for physical filing cabinets, further reducing costs associated with document management.

Environmentally friendly.

By reducing reliance on paper, check stubs maker contribute to environmental sustainability. Every year, millions of trees are cut down to produce paper products, leading to deforestation and habitat destruction. Switching to digital pay stubs helps conserve natural resources and reduce carbon emissions associated with paper production and transportation.

Enhanced security.

Online check stubs offer enhanced security features compared to traditional paper pay stubs. Digital documents can be encrypted to protect sensitive employee information, reducing the risk of identity theft and fraud. Additionally, electronic storage provides backup capabilities, ensuring that pay stubs are not lost or damaged in the event of a disaster.

How to Integrate Online Check Stubs into Business Operations

Choosing the right online check stub provider.

Before implementing online check stubs, businesses should research and evaluate different providers to find the solution that best meets their needs. Factors to consider include cost, features, security measures, and ease of use.

Setting up employee access.

Once a provider has been selected, businesses must set up employee access to the online platform. This may involve creating user accounts, providing login credentials, and offering training on how to access and interpret pay stubs online.

Implementing policies for digital recordkeeping.

To ensure compliance with relevant regulations and internal policies, businesses should establish clear guidelines for digital recordkeeping. This may include policies related to data privacy, document retention, and access controls.

Training employees on the new system.

Transitioning to online check stubs may require training for employees who are accustomed to receiving paper pay stubs. Businesses should provide comprehensive training sessions to familiarize employees with the new system and address any questions or concerns they may have.

Addressing Concerns and Challenges

Security and privacy concerns.

Some employees may express concerns about the security and privacy of their personal information when switching to online check stubs. Businesses can address these concerns by implementing robust security measures, such as encryption and multi-factor authentication, to protect sensitive data.

Employee resistance to change.

Resistance to change is common whenever new systems or processes are introduced in the workplace. To mitigate resistance, businesses should communicate the benefits of Online Paystub and involve employees in the decision-making process. Providing ongoing support and training can also help ease the transition.

Legal compliance issues.

Businesses must ensure that their online check stubs comply with relevant laws and regulations governing payroll and recordkeeping. This may include requirements related to data security, electronic signatures, and accessibility for individuals with disabilities.

Case Studies of Successful Integration

Example 1: Small business transition.

A small retail business with 20 employees recently switched from paper to online check stubs. By partnering with a reputable online payroll provider, they were able to streamline their payroll process and save valuable time and resources. Employees welcomed the change, citing the convenience of accessing their pay stubs online.

Example 2: Medium-sized company implementation.

A medium-sized manufacturing company implemented online check stubs as part of a broader digital transformation initiative. By integrating their payroll system with an online HR platform, they were able to centralize employee records and improve data accuracy. The transition was smooth, thanks to comprehensive training and support provided to employees.

Example 3: Large corporation adoption.

A large technology corporation with thousands of employees transitioned to online check stubs to reduce paper waste and improve efficiency. Despite initial concerns about security and privacy, robust encryption measures and regular security audits reassured employees. The transition was hailed as a success, resulting in significant cost savings and environmental benefits.

Measuring the Impact

Analyzing cost savings.

Businesses can measure the impact of integrating online check stubs by analyzing cost savings associated with paper reduction, printing, and storage. By comparing expenses before and after the transition, businesses can quantify the financial benefits of going digital.

Assessing productivity improvements.

Online check stubs can also lead to productivity improvements by reducing administrative burden and streamlining processes. Businesses can track metrics such as time spent on payroll processing and employee inquiries to gauge the efficiency gains achieved through digital transformation.

Gathering feedback from employees.

Finally, businesses should gather feedback from employees to assess their satisfaction with the new system. Surveys, focus groups, and one-on-one meetings can provide valuable insights into areas for improvement and help identify any lingering concerns or challenges.

Future Trends in Online Check Stub Integration

Advancements in technology.

As technology continues to evolve, online check stub providers will likely introduce new features and functionalities to enhance user experience and security. This may include integration with biometric authentication systems or the use of blockchain technology to further safeguard sensitive data.

Integration with other HR and payroll systems.

Online check stubs are just one piece of the larger HR and payroll ecosystem. In the future, we can expect tighter integration between online check stub platforms and other HR software solutions, such as time tracking, benefits administration, and performance management systems.

Potential regulatory changes.

As laws and regulations governing payroll and recordkeeping evolve, businesses must stay informed and adapt their online check stub practices accordingly. Changes related to data privacy, tax reporting, and electronic signatures may impact how businesses manage and distribute digital pay stubs.

Conclusion

In conclusion, integrating free online check stubs into business operations offers numerous benefits, including increased accessibility, cost savings, and enhanced security. By choosing the right provider, implementing robust security measures, and addressing employee concerns, businesses can successfully transition to digital pay stubs and realize the advantages of modernizing their payroll processes.

FAQs

1. Are online check stubs legally binding?

Online check stubs are legally binding documents that provide employees with detailed information about their pay and deductions. However, businesses must ensure compliance with relevant laws and regulations governing payroll and recordkeeping.

2. Can employees opt out of receiving online check stubs?

In some cases, employees may have the option to opt out of receiving online check stubs and continue receiving paper pay stubs. However, businesses should communicate the benefits of online check stubs and encourage participation in digital recordkeeping initiatives.

3. How secure are online check stubs?

Online check stubs are protected by robust security measures, including encryption and multi-factor authentication, to safeguard sensitive employee information. Regular security audits and compliance checks help ensure that online check stub platforms meet industry standards for data security.

4. Can online check stubs be accessed from mobile devices?

Yes, most online check stub platforms offer mobile-friendly interfaces that allow employees to access their pay stubs from smartphones and tablets. This provides added convenience for employees who prefer to view their pay information on the go.

5. What happens if an employee loses access to their online check stubs?

If an employee loses access to their online check stubs due to forgotten login credentials or other technical issues, businesses can provide support and assistance to help them regain access. This may involve resetting passwords, verifying identity, or contacting the online check stub provider for assistance.

Have A Look :-