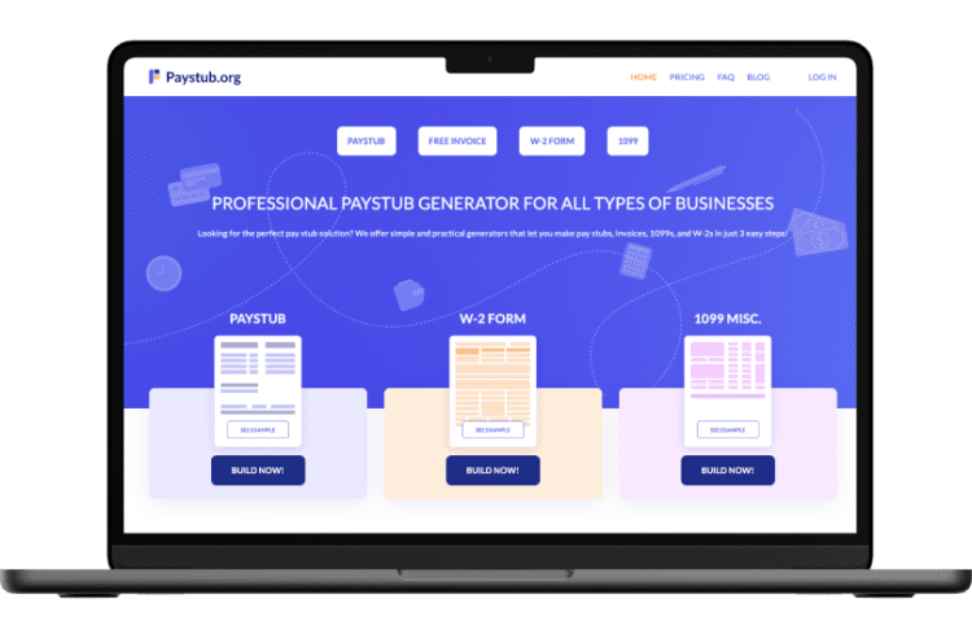

In the digital age, managing payroll efficiently is crucial for businesses of all sizes. Paystub software plays a vital role in streamlining payroll processes and ensuring accurate documentation for both employers and employees. Among the various tools available, a Paystub Generator stands out as a convenient solution to automate the creation of paystubs. In this article, we explore the importance of finding the right Paystub Generator for your business and how a Free Paystub Generator can be a cost-effective option.

Understanding the Need for Paystub Software

Paystubs are essential documents that provide employees with detailed information about their earnings, deductions, and taxes. Manual creation of paystubs can be time-consuming and error-prone, leading to inefficiencies and potential compliance issues. Paystub software simplifies this process by automating calculations, ensuring accuracy, and generating professional-looking paystubs in minutes.

Key Features to Consider in a Paystub Generator

When selecting a Paystub Generator for your business, it’s essential to consider key features such as customization options, security measures, compliance with tax regulations, integration capabilities with existing payroll systems, and a user-friendly interface. Customization allows businesses to add logos, adjust layout styles, and include specific information relevant to their industry or location. Security measures like encryption and data protection are crucial to safeguard sensitive employee information. Compliance with tax regulations ensures that generated paystubs adhere to legal requirements, avoiding potential penalties.

Benefits of Using a Free Paystub Generator

A Free Paystub Generator offers a cost-effective solution for small businesses or startups with limited budgets. While paid options may offer advanced features and dedicated support, a Free Paystub Generator can still provide essential functionalities for creating accurate paystubs without additional expenses. It’s important to review user reviews, feedback, and the reputation of the software provider to ensure the reliability and trustworthiness of the free tool.

Understanding Paystub Generators

A pay stub, also known as a paycheck stub, is a document provided to employees that details their earnings and deductions for a specific pay period. Paystub generators are online tools that automate the creation of these essential documents, offering businesses a convenient and efficient way to manage payroll processes. These tools enable employers to input employee information, salary details, deductions, and other relevant data to generate accurate pay stubs quickly.

The Benefits of Using a Paystub Generator

- Time-Saving: Paystub generators eliminate the need for manual calculations and paperwork, saving businesses valuable time in processing payroll.

- Accuracy: By automating the process, these tools reduce the risk of human error in calculating wages, taxes, and deductions.

- Compliance: Paystub generators help ensure that businesses comply with legal requirements regarding providing detailed pay information to employees.

- Convenience: Employees can access their pay stubs online, anytime, anywhere, making it easier for them to track their earnings and deductions

Key Features to Look for in a Paystub Generator

- Customization: Choose a paystub generator that allows you to customize the look and feel of the pay stubs to align with your brand identity.

- Tax Calculations: Ensure that the tool accurately calculates taxes, deductions, and with holdings based on the latest tax laws.

- Security: Opt for a paystub generator which prioritizes data security and encryption to protect sensitive employee information.

- Ease of Use: Select a user-friendly platform that simplifies the process of inputting data and generating pay stubs.

- Comprehensive Reporting: Look for a tool that provides detailed reports and summaries for better payroll management.

Finding the Right Paystub Generator for Your Business

When choosing a paystub generator for your business, consider the following factors:

- Cost: Evaluate the pricing structure of different paystub generators to find a solution that fits your budget.

- Features: Assess the features offered by each tool and determine which ones align with your business requirements.

- User Reviews: Look for feedback from other users to gauge the reliability and effectiveness of the paystub generator.

- Customer Support: Opt for a provider that offers responsive customer support to address any issues or queries promptly.

Factors to Consider When Choosing Paystub Software

When evaluating Paystub Software, businesses should consider factors such as pricing structure, customer support availability, scalability, cloud-based accessibility, and ease of use. Pricing structure varies among software providers, with options for monthly subscriptions, per payslip charges, or one-time purchases.

Customer support availability is crucial for resolving issues promptly and ensuring smooth implementation of the software. Scalability is important for businesses expecting growth in the future, as the software should be able to accommodate increasing payroll needs. Cloud-based accessibility enables remote access and collaboration, while ease of use ensures that employees can navigate the software efficiently.

Conclusion

Pay stub Software plays a critical role in simplifying payroll processes, ensuring accuracy, and maintaining compliance with tax regulations. A Paystub Generator automates the creation of paystubs, saving time and reducing errors associated with manual calculations. Whether opting for a Free Paystub Generator or a paid solution, businesses should prioritize features that meet their specific needs and budget constraints. By carefully evaluating key factors and considering the benefits of different software options, businesses can find the perfect Paystub Software solution to streamline their payroll operations effectively.

Have A Look :-